Annual Revenue Run Rate Calculator

Revenue run rate (RRR) is a vital number for subscription businesses. It helps predict how well a company will do financially in a year. Also called the annual run rate, it’s like looking at how fast a car is going now and guessing how far it will go in an hour.

To figure out the revenue run rate for your SaaS (Software as a Service) company, you look at how much money you’re making right now and use that to guess how much you’ll make in a whole year. It’s a simple idea, but it doesn’t consider things like getting more customers or losing some over time.

What Is Revenue Run Rate (RRR)

Revenue run rate, also known as sales run rate, is a way to predict how much money a business will make over a longer period, usually a year, based on past earnings. For instance, if your company made $15,000 in sales last quarter, your annual run rate would be $60,000. It assumes that your current sales will stay the same, using this data to estimate future performance for the whole year.

So, what does this mean?

Imagine you’re on a road trip and you’ve been driving at a steady speed for the past hour. You can use your current speed to guess how far you’ll travel in the next hour. That’s like how revenue run rate works for businesses—it uses your current earnings to predict future earnings.

Here’s why it’s important:

- Understanding Future Earnings: Revenue run rate helps businesses figure out how much money they can expect to make in the future. They can use data from weeks, months, or quarters to guess their yearly income, which helps with planning.

- Useful for Growing Companies: This method is particularly helpful for companies that are growing quickly. If your business is getting more customers and making more money each week, using recent data gives a better prediction of future earnings.

However, there are some things to watch out for:

- Not Perfect for Every Situation: Revenue run rate might not be the best tool if your business is about to make big changes, like introducing a new product or changing prices. It works best when things are staying pretty much the same.

- Limitations and Accuracy: While it’s a helpful estimate, it’s not foolproof. It assumes that the current financial situation will continue, which might not always be the case. And the farther into the future you’re trying to predict, the less accurate it becomes.

How to Calculate Annual Revenue Run Rate

To calculate the Revenue Run Rate for Company XYZ based on the information provided:

- Revenue in Period: $10 million (from the first quarter of 2023)

- Number of Days in Period: This depends on the specific period you’re considering. If we’re talking about a typical quarter (three months), it would be approximately 90 days (assuming 30 days per month).

- 365: This is the number of days in a year.

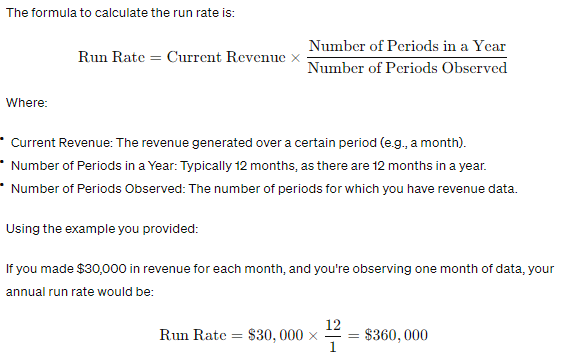

Using the formula:

Revenue Run Rate=Revenue in PeriodNumber of Days in Period×365Revenue Run Rate=Number of Days in PeriodRevenue in Period×365

Substituting the values:

Revenue Run Rate=10,000,00090×365Revenue Run Rate=9010,000,000×365

Revenue Run Rate=111,111.11×365Revenue Run Rate=111,111.11×365

Revenue Run Rate≈40,555,555.56Revenue Run Rate≈40,555,555.56

So, Company XYZ is operating at a Revenue Run Rate of approximately $40.56 million.

Why Do Companies Use Revenue Run Rate?

Companies often utilize Revenue Run Rate as a crucial metric for assessing their financial performance, particularly when they are relatively new or undergoing significant changes. Here’s why they find it valuable and some potential risks associated with its use:

Benefits of Revenue Run Rate:

-

Snapshot of Financial Performance: Revenue Run Rate provides a quick snapshot of a company’s revenue generation capability over a certain period, often extrapolated to a full year. This can be particularly useful for young companies with limited historical data.

-

Fundraising Tool: Startups or companies with limited credit history can leverage Revenue Run Rate figures when seeking investment. It provides potential investors with an estimate of future revenue potential, which can be crucial in securing funding for business activities.

-

Benchmarking Tool: Companies undergoing operational changes or management restructuring can use Revenue Run Rate as a benchmark to evaluate the effectiveness of these changes. It helps assess whether the alterations have positively impacted the company’s financial performance.

Risks Associated with Revenue Run Rate:

-

Assumption of Stability: Revenue Run Rate assumes that the financial environment will remain relatively stable, which may not always hold true in today’s unpredictable market. Relying solely on Run Rate figures for financial decision-making can be risky.

-

Seasonality: Industries with seasonal fluctuations, such as retail during the holiday season, may experience significant variations in revenue throughout the year. Calculating Revenue Run Rate during peak seasons may inflate estimates, while using data from slower periods may produce underestimated figures.

-

Changes in Company Performance: Revenue Run Rate often relies on the most recent data available, potentially overlooking events that could impact a company’s financial performance, such as product launches or market shifts. This may lead to skewed projections if not accounted for appropriately.

Addressing Churn: Safeguarding Subscription Revenue

In subscription-based businesses, customer churn poses a significant threat to forecasted revenue. When subscribers terminate their memberships or subscriptions, it can disrupt revenue projections, impacting financial stability. Calculating churn rate offers a proactive approach to anticipate and mitigate these effects on future performance.

Churn Rate Calculation:

- Churn rate quantifies the percentage of customers who discontinue their subscriptions within a specific period.

- By tracking churn rate, businesses gain insights into customer retention and revenue sustainability.

Automated Solutions for Churn Management:

- Manual calculation of churn metrics can be cumbersome and prone to errors, necessitating automated solutions.

- Tools like Chargebee offer dedicated features, such as the Churn Watch dashboard, to monitor critical churn metrics in real-time.

- These platforms provide actionable insights, empowering businesses to identify trends, address churn factors promptly, and optimize customer retention strategies.

Benefits of Churn Management:

- Proactively managing churn enhances revenue predictability and sustains business growth.

- By leveraging automated churn monitoring tools, businesses streamline operations and optimize resource allocation.

- Improved customer retention fosters long-term relationships, enhances brand loyalty, and drives sustainable revenue streams.

When Revenue Run Rate Is Beneficial for Businesses

Run rate can be particularly useful for businesses in various scenarios:

-

Starting a New Company:

- For new ventures, especially startups with limited historical data, run rate offers a way to gauge early financial performance.

- Executives, investors, and venture capitalists can use run rate to estimate the company’s expected performance, even with only a few weeks or months of data.

- If the financial environment is expected to remain stable, run rate can provide valuable insights into the company’s potential trajectory.

-

Restructuring a Current Company:

- During periods of restructuring, such as launching new products, revamping existing services, or implementing cost-saving measures, run rates serve as a consistent benchmark.

- Comparing run rates before and after changes allows management to assess whether the adjustments have positively impacted financial performance.

- If the run rate increases post-restructuring, it signifies successful changes; otherwise, it signals a need for reassessment or further adjustments.

-

General Reporting and Tracking:

- Beyond startup stages, businesses may continue to track and report run rates for ongoing performance evaluation.

- Run rate metrics are easily understandable and actionable, making them useful for setting key performance indicators (KPIs) and individual targets, such as for sales reps.

- However, caution should be exercised when using run rate for future budgeting, as it may lead to overspending if estimates are inaccurate due to unforeseen changes or seasonal variations.

Exercise Caution and Employ Proper Tools for Measuring Run Rates

Measuring your company’s run rate is invaluable for monitoring the performance of your subscription-based business, especially in its early stages. It provides a quick benchmark for revenue assessment. However, it’s crucial to handle this metric with care and accuracy to avoid potential pitfalls and negative outcomes.

Selecting the appropriate forecasting tools isn’t merely a luxury—it’s imperative. ProfitWell Metrics offers a robust solution to precisely determine your company’s run rate. This tool equips you to navigate challenges such as seasonality, demand fluctuations, cost management, labor strikes, and capacity changes effectively. Moreover, it fosters a deeper comprehension of fundamental forecasting principles.

Difference Between Revenue Run Rate and Annual Recurring Revenue (ARR)

Revenue Run Rate and Annual Recurring Revenue (ARR) are frequently conflated, yet they represent distinct metrics in business analysis:

Revenue Run Rate:

- Definition: Revenue Run Rate offers an annualized projection of revenue based on current performance data over a shorter period.

- Utility: It provides a snapshot of expected revenue for the entire year, often utilized in startup scenarios or periods of significant operational changes.

- Scope: While it’s a quick indicator of financial performance, Revenue Run Rate may not offer a comprehensive view as it doesn’t account for contractual commitments or recurring revenue streams exclusively.

Annual Recurring Revenue (ARR):

- Definition: ARR quantifies the total Annual Contract Value (ACV) of subscriptions within a Software as a Service (SaaS) business.

- Focus: It specifically encompasses revenue generated from ongoing customer contracts, excluding one-time purchases or fees.

- Applicability: ARR is primarily employed by subscription-based businesses, offering a stable predictor of revenue and facilitating growth rate analysis over time.

In essence, while Revenue Run Rate provides an annual projection of overall revenue, ARR hones in on the recurring revenue component derived from subscription contracts within SaaS enterprises. While each metric serves a distinct purpose, ARR is favored for its stability and relevance to subscription models, whereas Revenue Run Rate offers a broader, albeit less precise, assessment of financial performance.

Faqs - About Annual Revenue Run Rate

A “good” revenue run rate varies depending on the business. For startups, it differs from established corporations. However, a key benchmark is surpassing the annual cost of revenue to aim for profitability. Ultimately, the adequacy of a revenue run rate hinges on the business’s specific circumstances and goals.

- Utilizes available data to estimate a company’s annual revenue.

- Projects future revenue based on current performance data.

- Provides insights into revenue generation potential over a specific period.

- Measures negative cash flow, indicating how quickly a company depletes its available capital.

- Calculates the rate at which a new company spends its venture capital on overhead costs before achieving profitability.

- Reflects the sustainability of a company’s financial operations and its ability to reach profitability.

Run Rate EBITDA is a subjective metric utilized in M&A (Merger and Acquisition) reports. It involves incorporating a disclaimer when producing run-rate calculations within these reports. Sometimes, buyers may be requested to base their bids on the EBITDA run rate rather than the adjusted EBITDA figure based on actual results. This situation arises when the adjusted EBITDA fails to include a full year of value for new customer contracts.

- Measures the total revenue generated from subscription-based services within a single month.

- Provides insight into the monthly recurring revenue stream and helps assess the stability and growth of subscription-based businesses on a monthly basis.

- Enables businesses to track revenue trends, monitor customer churn, and assess the effectiveness of pricing strategies or promotional campaigns on a monthly basis.

- Estimates the total revenue that a business would generate over a full year based on current performance data, typically extrapolated from a shorter period (e.g., one month or one quarter).

- Offers a projection of the business’s annual recurring revenue, providing insight into its long-term revenue potential and sustainability.

- Helps businesses assess their overall financial performance and make strategic decisions regarding resource allocation, investment planning, and growth strategies on an annual basis.

- Resources:

- https://baremetrics.com/academy/annual-run-rate

- https://gocardless.com/en-us/guides/posts/what-is-revenue-run-rate/